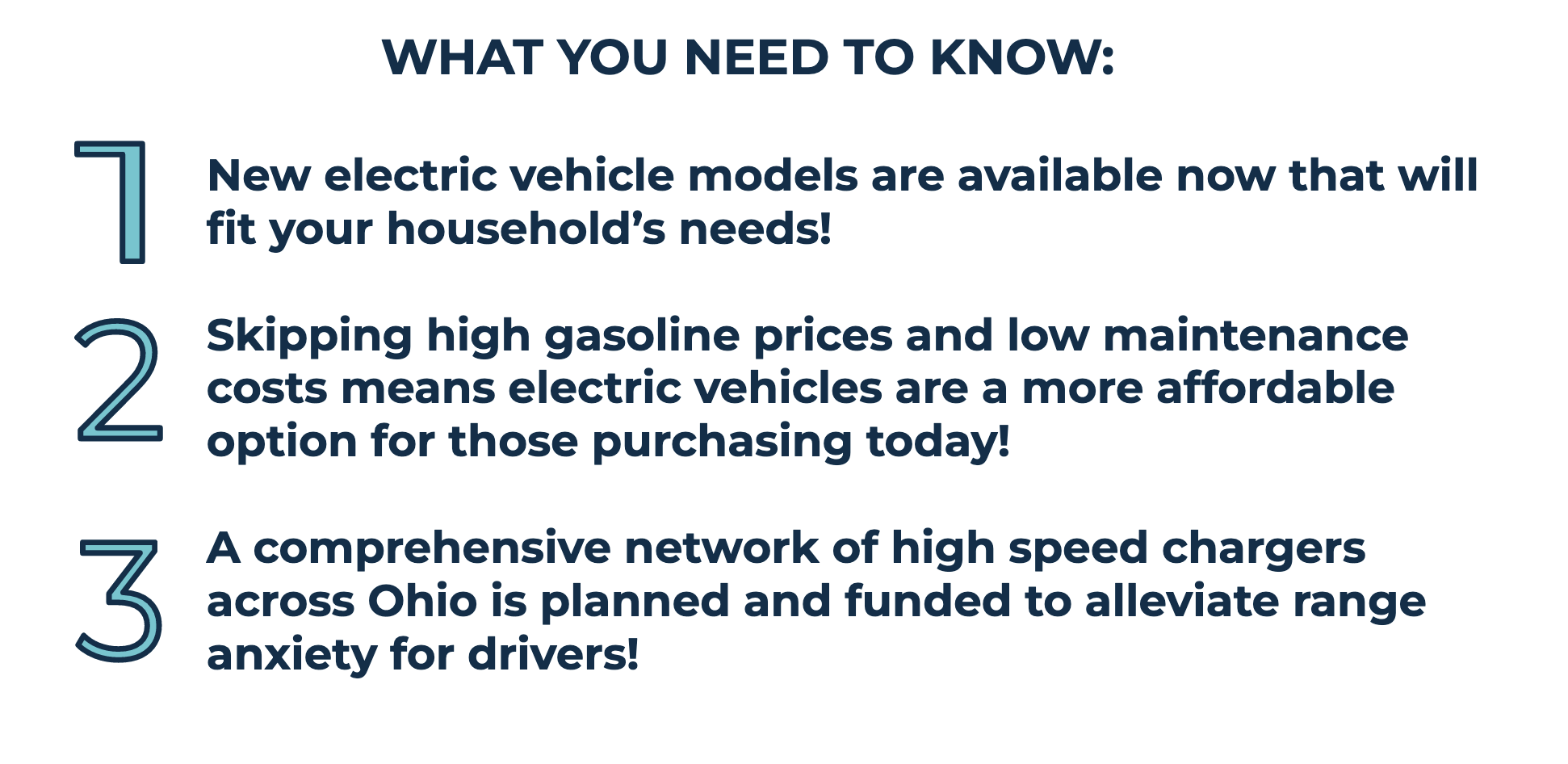

It’s Time for Ohioans to Make the Switch to Electric Vehicles!

Electric Vehicles Are More Affordable Than Ever

Between inflation and rising interest rates, buying any new or used vehicle can be a challenge. Fortunately, if you go electric, you can save thousands of dollars through a tax rebate. Thanks to new federal legislation, most new EVs now come with a $7,500 rebate, and most used EVs are eligible for a $4,000 rebate. There are also rebates available for installing an EV charger in your home, upgrading your electric panel, and more. Use this calculator from Rewiring America to see how much you can save by making the switch!

If you bought a new, qualified plug-in electric vehicle in 2022 or before, you may be eligible for a clean vehicle tax credit of up to $7,500 under Internal Revenue Code Section 30D. To qualify, the vehicle must have an external charging source, a gross vehicle weight rating of less than 14,000 pounds, and be made by a manufacturer that hasn't sold more than 200,000 EVs in the U.S. To claim the credit for a vehicle you took possession of in 2022, learn more at Credits for New Electric Vehicles Purchased in 2022 or Before | Internal Revenue Service.

Individuals and businesses who purchase a new plug-in electric vehicle or fuel cell vehicle in 2023 or later may qualify for a clean vehicle tax credit of up to $7,500. The credit is nonrefundable and depends on when the vehicle was placed in service, with a minimum credit of $3,751. To qualify, the vehicle must have a battery capacity of at least 7-kilowatt hours, a gross vehicle weight rating of fewer than 14,000 pounds, be made by a qualified manufacturer, undergo final assembly in North America, and meet critical mineral and battery component requirements. Learn more about the program at Credits for New Clean Vehicles Purchased in 2023 or After | Internal Revenue Service.

Starting January 1, 2023, individuals who purchase a used electric vehicle (EV) or fuel cell vehicle (FCV) for $25,000 or less from a licensed dealer may be eligible for a used clean vehicle tax credit. The credit is 30% of the sale price up to $4,000 and is nonrefundable. To qualify, the modified adjusted gross income must not exceed $150,000 for married filing jointly or a surviving spouse, $112,500 for heads of households, or $75,000 for all other filers. The vehicle must have a sale price of $25,000 or less, a model year at least 2 years earlier than the purchase year, and a gross vehicle weight rating of less than 14,000 pounds. The vehicle must also be primarily used in the United States and be an eligible FCV or plug-in EV with a battery capacity of at least 7-kilowatt hours. Purchases made before 2023 don't qualify. Learn more about the program at Used Clean Vehicle Credit | Internal Revenue Service.

The Alternative Fuel Vehicle Refueling Property Credit provides a tax credit for alternative fuel vehicle refueling and charging property in low-income and rural areas. Alternative fuels include electricity, ethanol, natural gas, hydrogen, biodiesel, and others. Businesses can claim up to a 30% credit for projects meeting prevailing wage and apprenticeship requirements. The qualified alternative fuel vehicle refueling property must be located in low-income or rural areas. The credit is 6% of the cost for businesses, limited to a $100,000 credit per item of property. For individuals, the credit is 30%, limited to $1,000. We are still awaiting more guidance from the Internal Revenue Service (IRS) about this program.

Charging Your EV Is About To Get A Lot Easier

So you want to go electric, but you’re worried about where you’ll charge your EV during longer road trips? We have good news! Ohio is now part of a national program to install thousands of EV chargers along highways across the country. Beginning later this year, Ohio will be adding up to 30 additional fast charging locations, with at least four charging ports at each location. Learn more about the program and look at the interactive map on the Drive Ohio website!